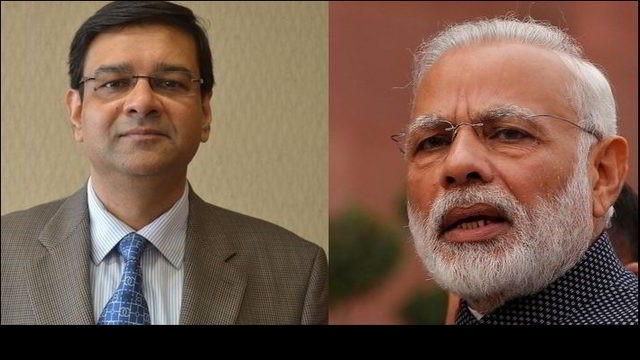

RBI Governor Urjit Patel met Prime Minister Narendra Modi to iron out differences between the central bank and the government, in a sign that there could be a thawing of relations after the unprecedented rift.

Sources said that the two sides agreed to a compromise formula – the Centre would soften its stand on seeking surplus reserves of the RBI and the central bank would cede to the demand of relaxing some of its lending curbs - during the meeting held on Friday.

As part of the understanding, the Reserve Bank of India is likely to let some banks out of its Prompt Corrective Action (PCA) framework, allowing them to lend more, sources said.

The curbs were imposed because the banks had a low capital base and major bad debt problems. The 11 banks had been barred from lending unless they reduced their bad debt levels, improved their capital ratios and became profitable.

The government, however, argued that the restrictions went too far and reduced the availability of loans for small and medium sized businesses.

The government and the RBI, sources said, have agreed to merge some of the banks on the list, to take them out of the PCA radar and have also settled on a special dispensation to ensure that credit for small and medium businesses does not suffer as a result of the RBI’s crackdown on non-performing assets.

The Centre, on its end, has decided not to push hard for the surplus reserves of the central bank to help fund its fiscal deficit, sources said.

The RBI currently hands over its profits earned from various activities in the form of a dividend. But reports stated the government had also wanted to tap Rs 3.6 lakh crore of RBI's capital reserves. The RBI consistently pushed back against the demand, and said the move had several pitfalls.

The government had two days ago denied seeking the money, but accepted that it wanted the RBI to fix "appropriate" economic capital framework.

Sources said the Narendra Modi government will also not ask the RBI for a special window for Non-Banking Financial Companies (NBFCs).

The government had wanted the RBI to provide more liquidity to the shadow banking sector, which has been hurt by the defaults of major financing company, Infrastructure Leasing & Financial Services (IL&FS).

Those defaults triggered sell-off in bonds and stocks of NBFCs. The government was asking the RBI for a dedicated liquidity window for these lenders similar to one allowed during the 2008-2009 global financial crisis.

Sources added that with most of the issues being sorted, there would be no resignations in the Mint Street.

It had been reported earlier that Patel could tender his resignation if the Centre pushes ahead with its demands and invokes its never-used before powers under Section 7 of the RBI Act to direct the bank.

The understanding on issues comes just a week ahead of the central board of directors meeting on November 19.

Tensions between the two sides came to the fore last month when RBI Deputy Governor Viral Acharya gave a speech that blew the lid off a fractious dispute between the bank and the government.

Acharya said that undermining central bank independence could be “potentially catastrophic”, and he even cited meddling by the Argentine government in the affairs of its central bank in 2010 – prompting big drops in that nation’s financial markets - as a sign of how bad things can get.

Government officials, on the other hand, said they were increasingly frustrated by the intransigence of Patel and his team to address its demands and engage in constructive dialogue.

.jpeg)