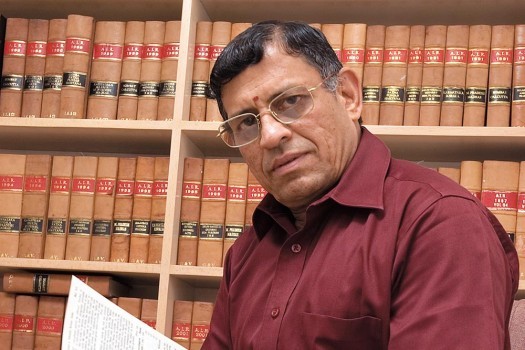

In an indication that the Centre and RBI are still some ways away on resolving differences, RSS ideologue and part time director S Gurumurthy lashed out at several policies of the Urjit Patel-led central bank just days ahead of the key board meet.

Delivering a lecture on the state of the economy, Gurumurthy backed the government’s stance on issues like easing credit rules for state-run banks and blamed the RBI for its policy of setting aside funds for bad loans.

“NPA has been developing since 2009 and it peaked in 2014. At that time RBI did not say ‘you provide’ but in 2015 it said ‘you provide’. So, providing at one go is the problem. If they had said you provide over five years this wouldn’t have happened,” he said.

He said that RBI should have gone for a more gradual approach. “Any policy that lacks gradualism will always produce shocks, will invite a crisis where none exists. You want to avoid a crisis by policy but the same policy also can bring a crisis and this balance has not been maintained in forcing NPA provisions.”

Gurumurthy’s public rebuke of the central bank comes at a time of heightened tension between the government and RBI over a host of issues, which have triggered an unprecedented rift.

Prime Minister Narendra Modi and Patel had met last week to iron out the differences, but the address puts some doubt over how far apart the two sides still are on these issues. His own appointment on the board as a director was said to be one of the contentious issues between the government and the central bank.

Gurumurthy said that policy measures like capital adequacy norms should have been framed with the big picture in mind and the RBI should not blindly follow the United States as India was a bank-driven economy, like Japan, and not market driven like the US.

He said that unlike the US, where businesses prefer to raise capital from the stock market, the main source of funds for businesses in India are banks.

“Rules that limit access to finance for small businesses will have serious implications for the Indian economy, he said.

“The standoff between RBI and the government is not a happy thing at all… An alternative is necessary and it exists also… That is part of the overall correction of the Indian mindset,” he said during a talk at the Vivekanada International Foundation.

.jpeg)