The much-awaited RBI board meet has started. Financial markets, banks and corporate houses were eagerly waiting for Monday’s crucial Reserve Bank of India board meeting. All eyes are set upon the meet as it is likely to set the tone on sensitive issues like easier loan sanctions to micro, small & medium enterprises (MSME), relaxation of prompt corrective action (PCA) on weaker banks, and fund transfer to the government.

RBI, which had taken a stern stance, is likely to relax the PCA norms only on those banks that are showing signs of a turnaround through faster resolution of non-performing assets (NPAs) and shedding of non-core assets. The other option being weighed is a committee being jointly set up by the government and the RBI to access the merits of the corrective action undertaken by the ailing banks. Last year, 11 public sector banks were brought under the RBI's revised PCA framework which set tougher norms and banned them from lending.

Coming back to the members, RBI's board meet members include Governor Urjit Patel and his four deputies as 'full-time official directors', while the rest 13 have been nominated by the government, including two Finance Ministry officials -- Economic Affairs Secretary Subhash Chandra Garg and Financial Services Secretary Rajiv Kumar.

There are also Swadeshi ideologue Swaminathan Gurumurthy and cooperative banker Satish Marathe, nominated by the government as "part-time non-official directors".

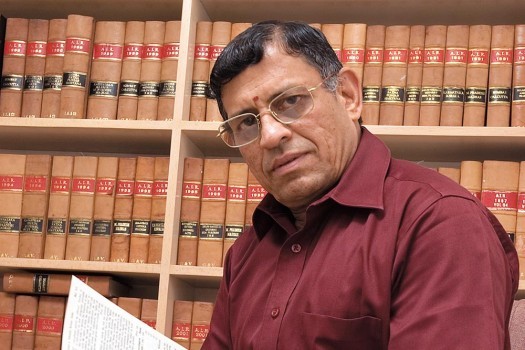

But it's Swaminathan Gurumurthy, primarily a chartered accountant who turned newspaper columnist, has set the tone for the meet days before it started.

While delivering a lecture on the state of the economy, RSS ideologue S Gurumurthy slammed RBI.

Gurumurthy backed the Modi government’s stance on issues like easing credit rules for state-run banks and blamed the RBI for its policy of setting aside funds for bad loans.

“NPA has been developing since 2009 and it peaked in 2014. At that time RBI did not say ‘you provide’ but in 2015 it said ‘you provide’. So, providing at one go is the problem. If they had said you provide over five years this wouldn’t have happened,” he said.

He said that RBI should have gone for a more gradual approach. “Any policy that lacks gradualism will always produce shocks, will invite a crisis where none exists. You want to avoid a crisis by policy but the same policy also can bring a crisis and this balance has not been maintained in forcing NPA provisions.”

Gurumurthy's comments hold relevance as he is associated with the economic wing of Rashtriya Swayamsevak Sangh (RSS), an organisation from which the BJP ideology is heavily influenced.

Meanwhile, Gurumurthy acknowledged that the stand-off between the government and the Reserve Bank was not a happy situation. Howver, his comments that stir outrage in certain sections came amid the ongoing rift between the Finance Ministry and the RBI over several issues, including capital framework of the central bank and easing of lending norms for the NBFC sector.

On Friday, the RBI board member further said that India would’ve fared better if it ‘thought independently’ and said ‘Abenomics in Japan is against all theories and is a success in generating business, jobs and exports.

He said that in India, we ‘trolled anyone who thinks independently’

He wrote on Twitter:

“Who have not listened to my speech at @vifindia fully, not reading researches in development economics, trivialise suggestion of deficit financing. Challenge them to counter the facts. Had India partly deficit financed during 2014-17... Read on and respond

Bank credit to GDP ratio was down from 10.9% in 2010 to 5.7% in 2015 to 4.8% in 2016. Fiscal deficit also came down in this period. With the result the aggregate money into the economy halved from 17.4% of GDP to 8.4%. I suggested to govt when credit goes down deficit should rise

FRBM law prevented this. I suggested the amendment of FRBM law. A committee was also appointed. The FRBM is law is outdated after 2008. Monetary expansion is now the order of the day. Deficit financing of deficit is not per se bad. In times banking stress it is good

The IMF said on 1999 deficit is preferable to govt borrowing from banks and crowding out private investment which is happening in India in a big way. Had India not followed theoreticians it would have fared better. The US & EU ignored theoreticians in 2008 & survived.

Abenomics in Japan is against all theories and it is a success in generating business, jobs and exports in Japan. It is because they think independently. Here we troll anyone who think independently. Independent thinkers have always struggled against howls of crowds.”

.jpeg)